Green Infrastructure with respect to Gentrification and Displacement

Updated 2020-09-10

1 Summary

Predictive variables for gentrification and displacement are examined to answer questions:

- Will improvements to a neighborhood – through green infrastructure or creating a public open space – cause the area to gentrify and displace current residents?

It depends on how to define gentrification. Gentrification is a process, which is defined differently using various indicators. For example, a study for Seattle defined gentrification with low income and education increase while other study for Indianapolis did it with low income and growth in home value and education. Furthermore, the result of gentrification, for example eviction, could be the indicator to define gentrification in that indicators and causes could be different. In general, gentrification caused by neighborhood change leads to involuntary displacement of residents. Thus, it is important to know what factors change neighborhood condition. In addition, what kind of infrastructure would be installed, is also another factor to the degree of neighborhood change. Having green infrastructure positively affects living quality of the neighborhood, thus increases the value of real estate around.

To answer the question, which neighborhood the green infrastructure would be located in should be identified. For example, based on the categories described in “The uprooted project”, if the infrastructure is located in early type 1 tracts, where mostly low income households are with high increase of appreciation of housing market, housing the infrastructure in the tract would expedite the appreciation. On the other hand, if the infrastructure is located in early type 2 tracts, where demographic change is going on with low increase of appreciation, having the infrastructure would be a seed to housing market change.

- What causes areas to gentrify? Is it just a regional real estate function? Or its improvements like upzoning, bringing in light rail etc.?

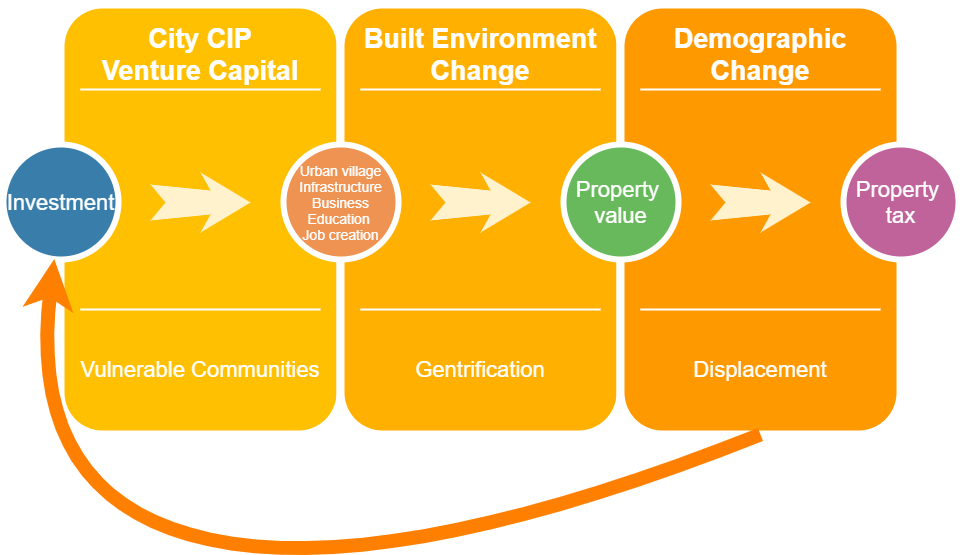

Investment for economic activities such as housing market, business, infrastructure, etc. leads to demographic and built environmental changes, which would cause gentrification, displacement and exclusion.

Suggested causes for gentrification - for the tracts with higher vulnerability (with respect to renters, education, income, and race), would be infrastructure investment or development because this will lead to demographic changes, and neighborhood condition, housing market, and economic changes. Capital investment on projects such as expanding urban village, developing business center for companies, establishing state public educational institutes, etc. will change the built environment and cause demographic change due to the job creation. This phenomenon will increase property value of housings adjacent to the development and finally property tax will increase. The state property tax in turn goes back to the City of Seattle for the projects of further development according to the capital improvement plan (CIP).

Gentrification cycle

Four indicators are suggested with respect to the argument above:

- Vulnerable community index (race, renters, education, income)

- Urban village development (upzoning) index

- Proximity to jobs and nature (university, companies, waterfront, etc.)

- Higher housing value

- How much has green infrastructure been REPORTED to increase a property’s value?

Many studies have found green infrastructure has positive impacts on property values.

“Transferring water resource to public ownership will increase a property’s sale price by 0.0353% for a wetland and 0.1177% for a stream” (Netusil, 2013);

“Properties on tree-lined streets are valued at up to 30% more than those on streets without trees” (“Benefits of Green Infrastructure”);

“Realtor based estimates of street tree versus non street tree comparable streets relate a $15-25,000 increase in home or business value” (Burden, 2006);

25 percent of survey participants see increasing property values (Mell et al., 2013);

“Marginal benefits to one household of preserving neighboring open space range from $994 to $3,307 per acre of farmland that is preserved, depending on whether it is publicly or privately owned” (Irwin, 2002);

“The effect of neighborhood association-owned forest and water feature was approximately 8% at the mean sale price with a value of $14488 for association-owned forests, and $14681 for a water feature” (Bowman et al., 2012); and

“Increase in home price is approximately $18 for every acre of public park within walking distance” (Bowman et al., 2012).

Specially bioswales are also known to improve local property values (Anderson, 2018). O’Neill (2013) mentioned that “the neighborhoods will see an increase in property values and habitability due both the functional and aesthetic value of the bioswales.” Furthermore, Ward et al., (2008) argued that the property value of the green grid in north Seattle (on street bioswales) increases about 3.5 to 5 percent.

In addition, Gurdon and Jakuba (2018) shows two cases which prove increase of property values around wastewater treatment facilities.

- What factors contribute to increased property values?

CIP and private venture capital investments seem to increase property values by developing local infrastructure which serves citizens. In addition, proximity to jobs and nature could be also increasing property values. Jobs are normally created by capital investments and accommodating companies. Increased property value causes higher property tax, which becomes the revenue to CIPs.

Housing market trend would be relevant to gentrification. And housing market trends seem to follow venture capital investment. In this regard, venture capital could be a cause of gentrification on tracts with higher vulnerability.

Property values around Green lake, Roosevelt reservoir, waterfront view, etc. are higher on the premise of the fact that they are close to downtown where most of the business activities are happening. So It can be clearly assumed that the proper indicators for gentrification are the combination of the close distance to the business or commercial center and natural benefits such as park, waterfront view, etc. Additionally, because there is higher demand for student housing around campus, the housing values around campus(e.g., UW has over 40,000 students) also seem higher from the perspective of source of income from renting.