3 Factors increasing property values

CIP and private venture capital investments seem to increase property values by developing local infrastructure which serves citizens. In addition, proximity to jobs and nature could be also increasing property values. Jobs are normally created by capital investments and accommodating companies. Increased property value causes higher property tax, which becomes the revenue to CIPs.

3.1 Property values and property taxes

Appreciation of property - the appraisal process will help us understand what indicators they look at when they value a house. Market trends, similar type of the property in neighbor, and the condition of the house are affecting how values are determined.

“A property’s appraisal value is influenced by recent sales of similar properties and by current market trends. The home’s amenities, the number of bedrooms and bathrooms, floor plan functionality, and square footage are also key factors in assessing the home’s value. The appraiser must do a complete visual inspection of the interior and exterior and note any conditions that adversely affect the property’s value, such as needed repairs” (Fontinelle, 2020).

“Each year, our accredited appraisers assess your property at its full market value using one or all of three approaches: Market (comparable sales), Cost (reproduction or replacement cost, less depreciation) or Income (income or capitalization of economic rents). They also state that they value homes in Seattle, and across the county, based on 100% of “true and fair” market value. Taxation is the sole purpose of the assessed value. This figure is used to determine the amount of property tax charged for homes in Seattle. In Washington State, property taxes can be used to cover a variety of government expenses, including schools, police and fire services, sewage, infrastructure and more. In some ways, the appraised value (determined by a licensed home appraiser) is similar to the fair market value mentioned earlier. The distinction is that the appraisal is one person’s opinion, while the fair market value can be determined by anyone who evaluates local real estate conditions, such as an agent" (“Market Value 101: How Much,” 2016).

“Seattle, Washington is without doubt one of the hottest real estate markets in the country right now. It has been for a while. High demand and limited inventory have forced home buyers to compete fiercely, especially in the more sought-after areas. As a result of these trends, the median home price in Seattle recently rose to $755,600” (“Seattle 2020 Mortgage,” 2020).

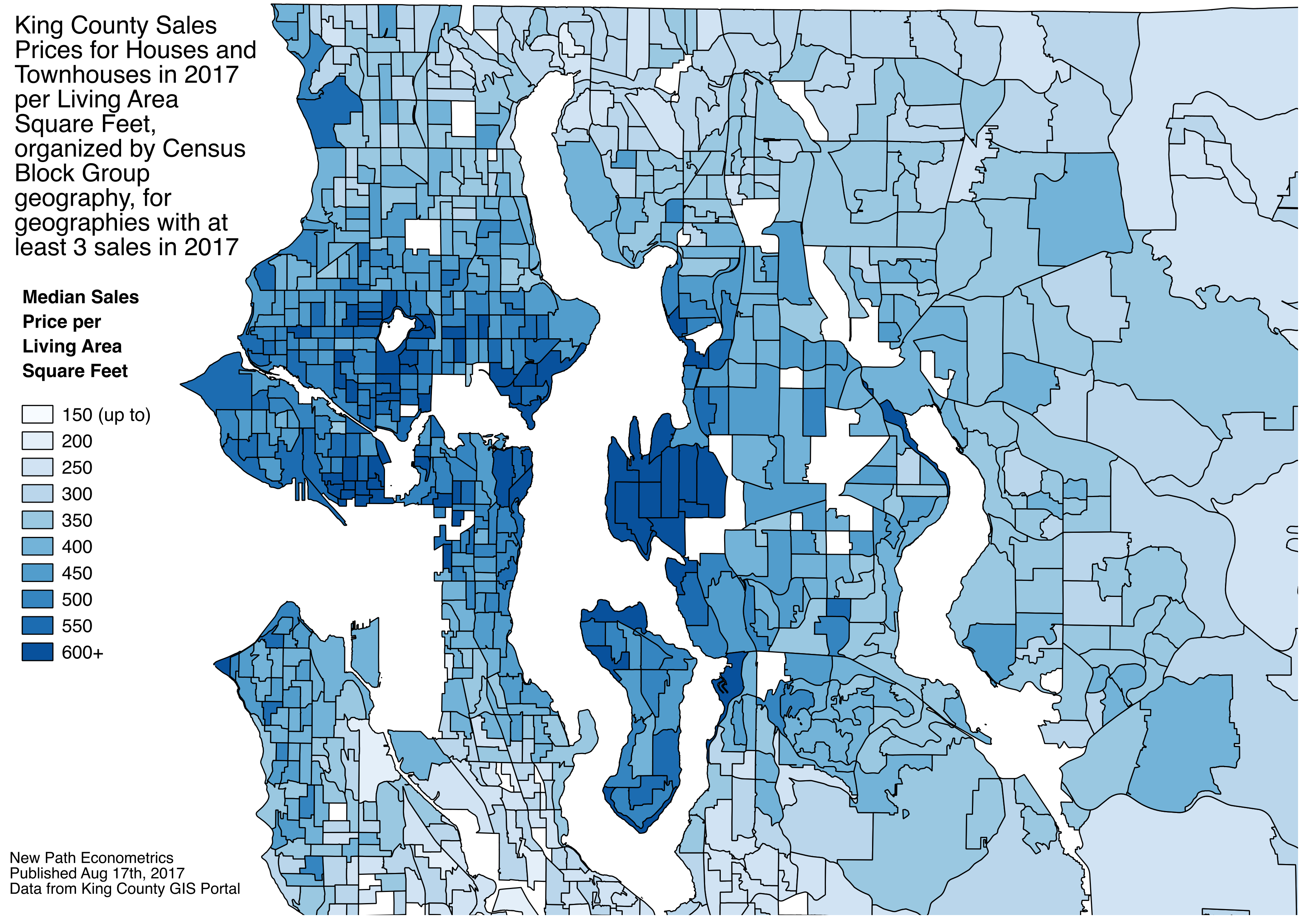

The trend of land value shows that areas near business regions, where companies and commercial districts are located, have higher land values.

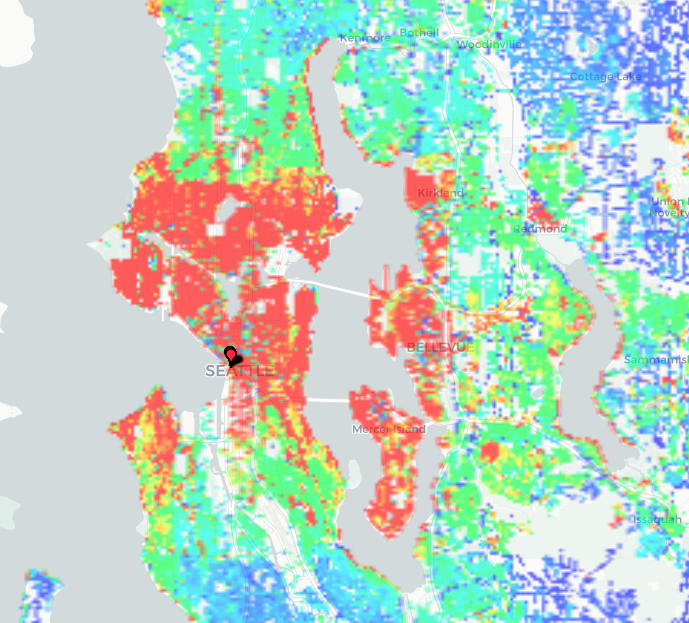

Land value in sqft in Seattle (Source: city-data.com)

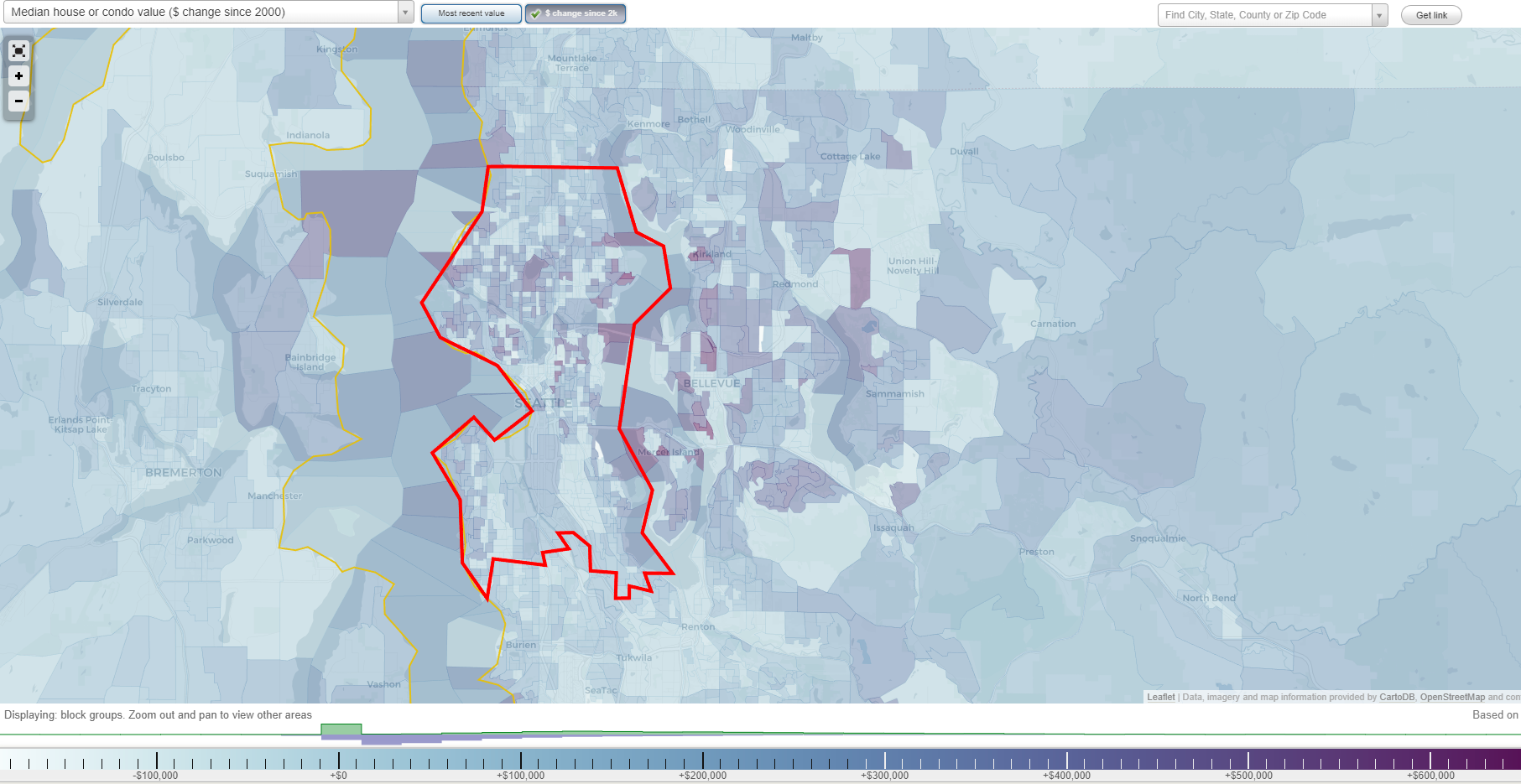

On the other hand, median house value changes since 2000 show distinguishable area with higher increases. The areas with higher house value change are proximity to jobs and nature (university, companies, waterfront, parks, etc.).

Median house value change since 2000 in Seattle (Source: city-data.com)

3.2 Capital improvement plan

“A capital improvement plan (CIP), or capital improvement program, is a short-range plan, usually four to ten years, which identifies capital projects and equipment purchases, provides a planning schedule and identifies options for financing the plan” (“Capital improvement plan,” 2020).

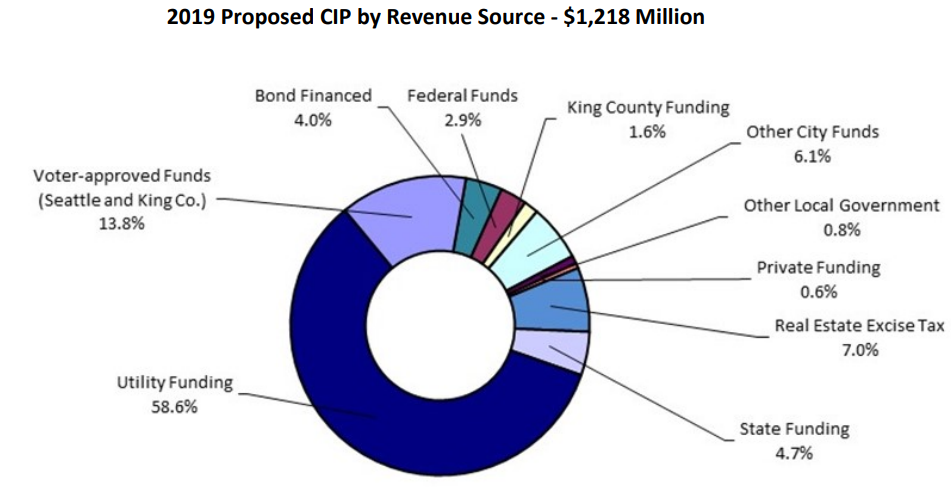

“Like all large municipalities, Seattle relies on a variety of sources to pay for capital projects. These include locally generated revenues (taxes, fees, voter-approved levies, and user fees), intergovernmental revenues (including state and federal grants), private funding (franchise utilities, philanthropy) and debt issuance. These traditional sources continue to provide the majority of funding for capital facility investments. The City’s level of capital investment is based on the mix and amount of financial resources available to the City” (“2019 - 2024 Capital Improvement Plan Overview,” 2019).

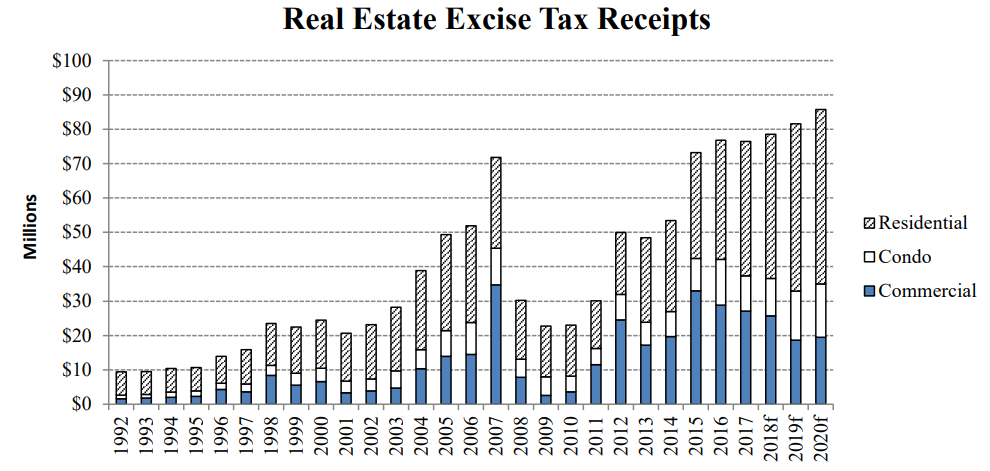

“Funding of the City’s general government capital program is highly dependent on revenue from Real estate exercise tax (REET)” (“2019 - 2024 Capital Improvement Plan Overview,” 2019).

Real estate exercise tax receipts in Seattle (Source: “2019 - 2024 Capital Improvment Plan Overview,” 2019)

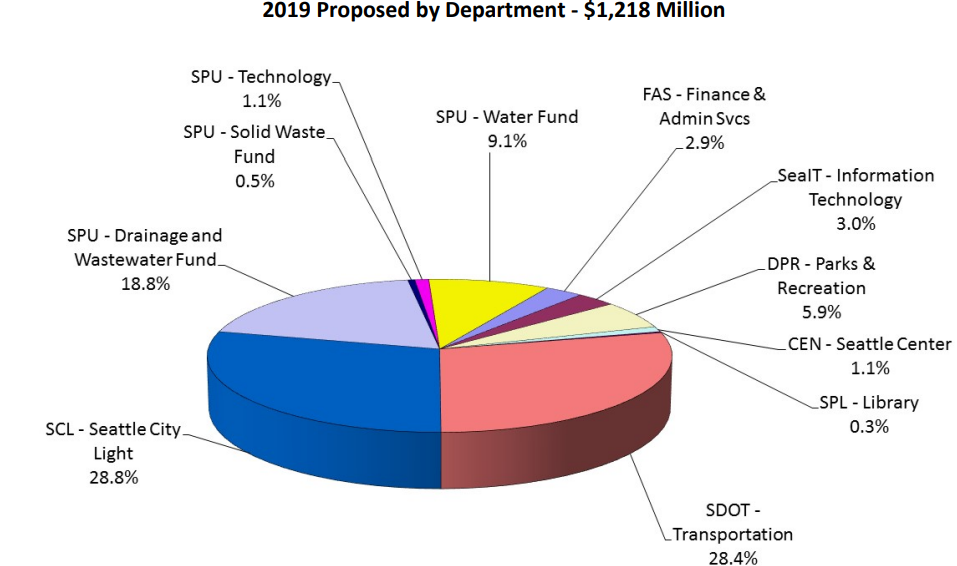

Proposed CIPs by department are mainly electricity and transportation followed by drainage and wastewater, water, park, and recreation projects.

Proposed CIPs in 2019 (Source: “2019 - 2024 Capital Improvment Plan Overview,” 2019 )

Most of funds come from utility funding.

Proposed CIPs by revenue in 2019 (Source: “2019 - 2024 Capital Improvment Plan Overview,” 2019)

Property tax is also a source of fund for the local CIPs. “The passage of the Park District is the culmination of the Parks Legacy Plan project, led by the Parks Legacy Plan Citizens’ Advisory Committee. The goal of the Park District is to provide long term, stable funding to support recreation programming, parks projects and the critical needs for investment in major and ongoing maintenance. In 2016, the Parks District began collecting property tax revenue, accumulating the first year of full funding for Park District projects. The Park District will provide over $29 million in 2019 for major maintenance and capital projects” (“2019 - 2024 Capital Improvement Plan Overview,” 2019).

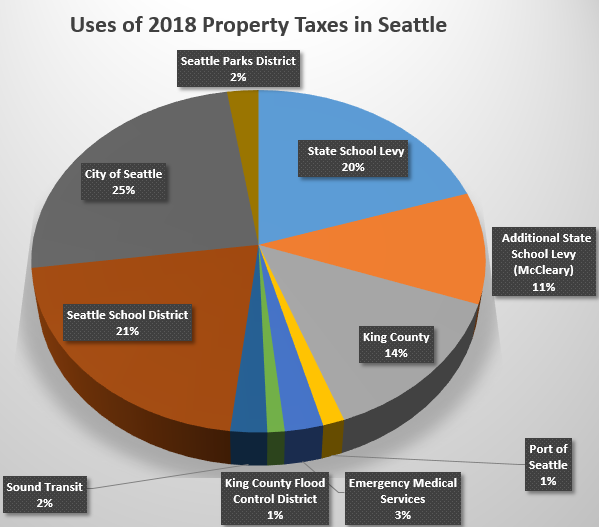

“The average effective property tax rate in King County is 0.95%. It’s also the county with the state’s highest median annual property tax payment at $4,254. In Seattle, the total rate is about $8.29 per $1,000 in assessed value” (“Washington state property,” 2020).

25% of property taxes in Seattle in 2018 went to the city while rest of property taxes were used for other purposes.

Tax uses (Source: “Herbold: Where do your property taxes go?,” 2018)

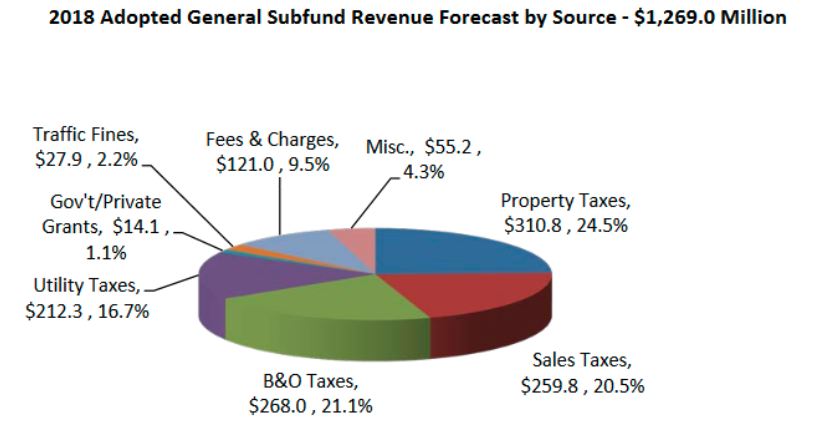

Property tax contributes 24.5 percent to the general subfund in Seattle.

General subfudn revenue in 2018 (Source: “Herbold: Where do your property taxes go?,” 2018)

3.3 Venture capital

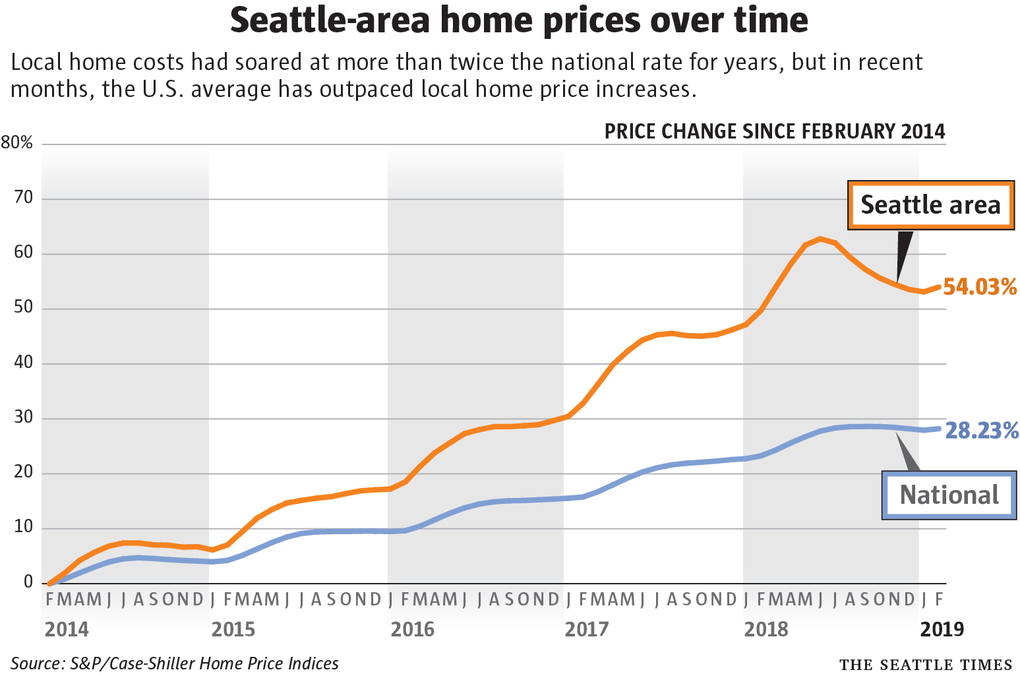

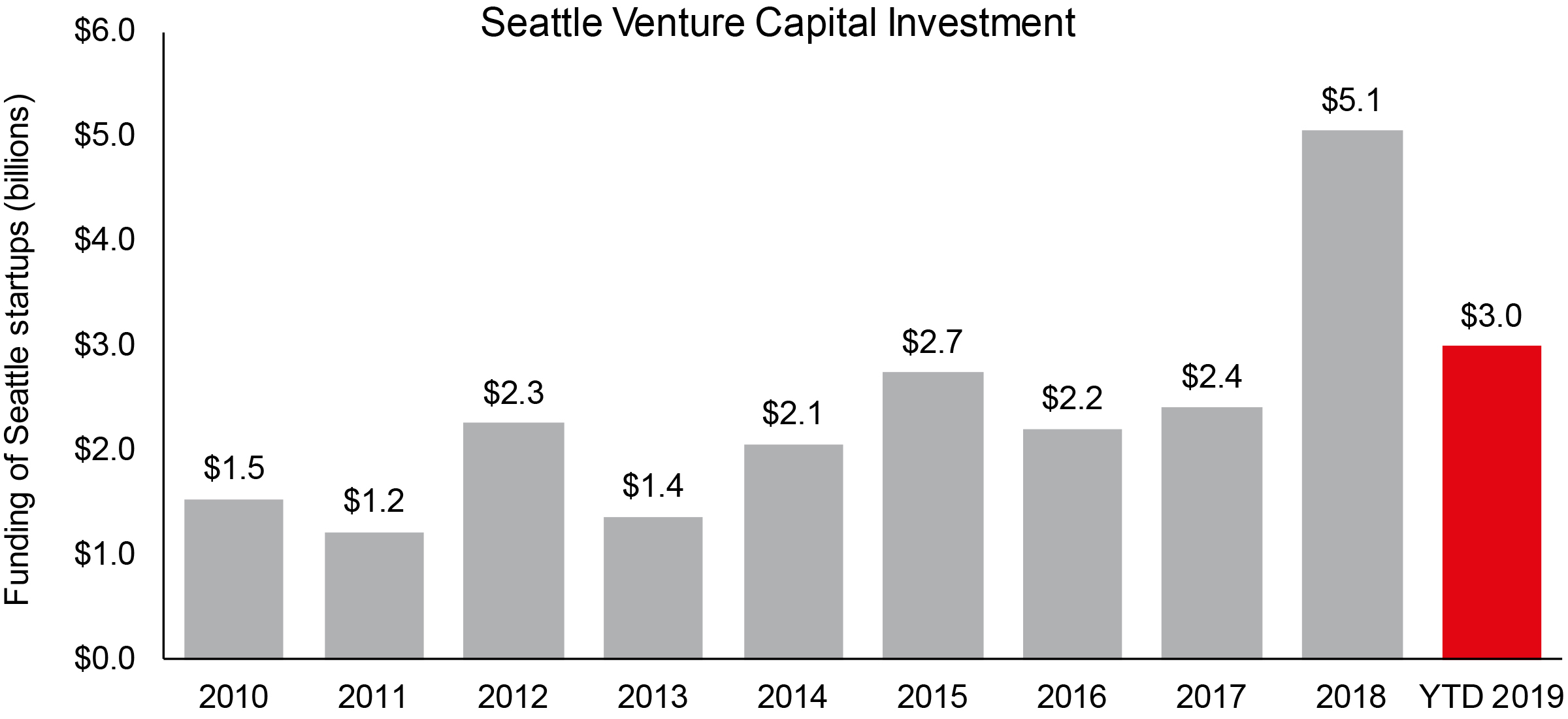

Housing market trend would be relevant to gentrification. And housing market trends seem to follow venture capital investment. In this regard, venture capital could be a cause of gentrification on tracts with higher vulnerability.

Housing prices in Seattle

Venture capital in Seattle (Source: “Seattle on pace,” 2019)

3.4 Proximity to jobs and nature

Property values around Green lake, Roosevelt reservoir, waterfront view, etc. are higher on the premise of the fact that they are close to downtown where most of the business activities are happening. So It can be clearly assumed that the proper indicators for gentrification are the combination of the close distance to the business or commercial center and natural benefits such as park, waterfront view, etc. Additionally, because there is higher demand for student housing around campus, the housing values around campus(e.g., UW has over 40,000 students) also seem higher from the perspective of source of income from renting.

Sales prices for houses in Seattle in 2017